Low connectivity and high internet taxes are stifling the nation’s potential, says Jazz CEO.

Key Takeaways:

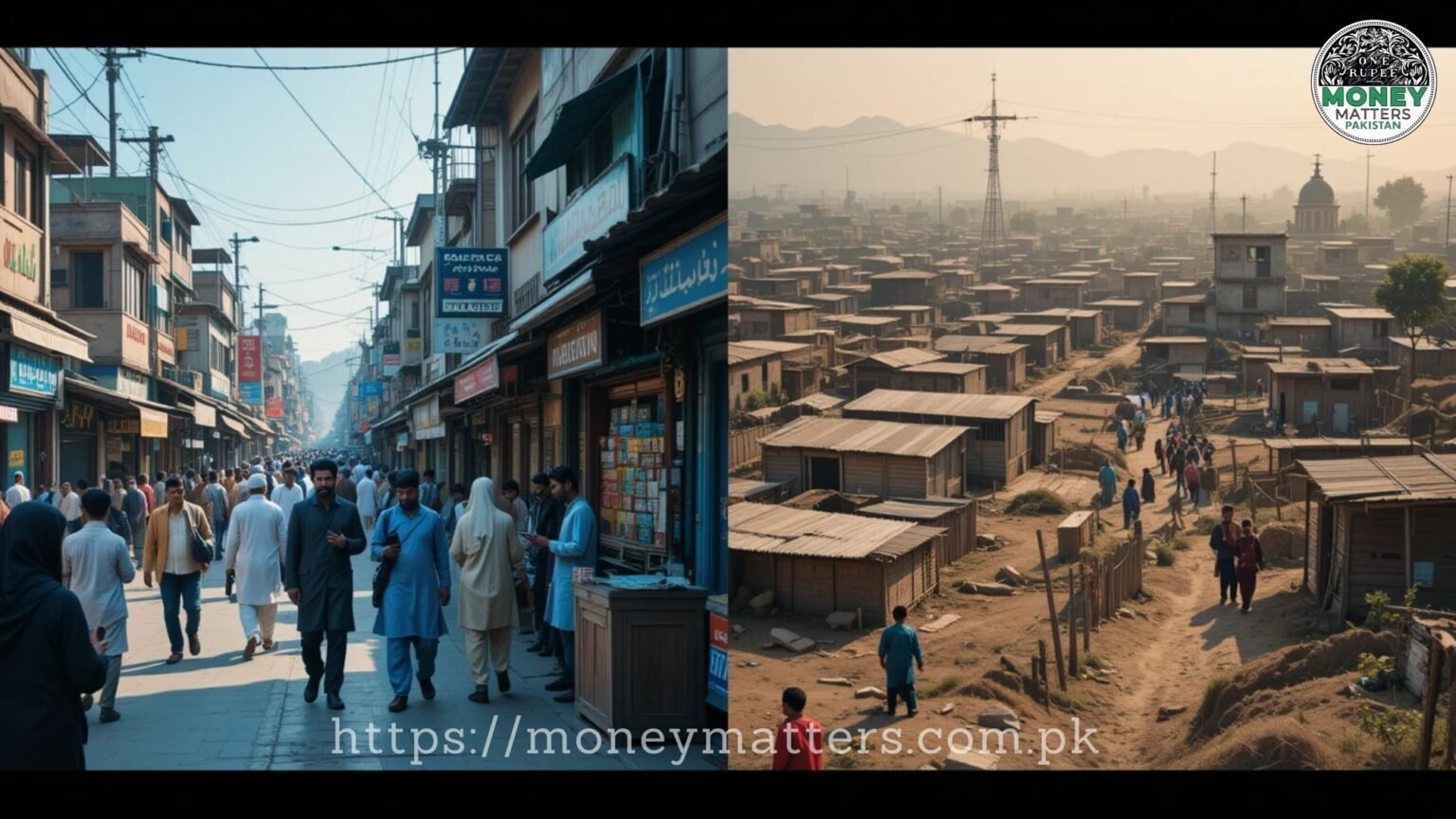

- Pakistan faces a significant connectivity gap, with a large portion of the population lacking access to 4G and basic telecom services.

- High taxes on internet usage and a shortage of spectrum are major obstacles to digital expansion.

- Slow digital adoption, particularly in retail payments, is hindering economic progress.

- Experts urge the government, investors, and telecom operators to share responsibility in bridging the digital divide.

- Practical solutions include issuing CNICs, mobile phones, and bank accounts to citizens at 18 and promoting cost-effective payment systems.

Islamabad, Pakistan – April 17, 2025 – Pakistan’s economic potential is being significantly hampered by a deep-rooted digital divide, experts warned at the Leaders in Islamabad Business Summit 2025. Aamir Ibrahim, CEO of Jazz, highlighted that nearly 30% of the country’s population cannot access 4G, 11% struggle with basic 2G calls, and only a mere 2% have broadband access.

Despite available infrastructure like RAAST, digital banks, and NADRA’s identity database, only 5% of retail payments are conducted digitally. This contrasts sharply with countries like Sweden and Australia, where digital payment rates exceed 90%.

Ibrahim pointed out that Pakistan is among the most spectrum-starved nations globally, further exacerbated by high internet taxes – a 15% withholding tax and a 19.5% GST. This combination severely restricts digital expansion and limits the potential of smartphones as “the greatest equalizer of the modern era.”

The slow adoption of digital payments is another critical concern. Despite available infrastructure like RAAST, digital banks, and NADRA’s identity database, only 5% of retail payments are conducted digitally. This contrasts sharply with countries like Sweden and Australia, where digital payment rates exceed 90%.

Ibrahim called for a shared responsibility between the government, investors, and telecom operators to address these challenges. He proposed practical measures, including providing every citizen with a CNIC, mobile phone, and bank account at the age of 18 to foster a lifelong digital identity. He also advocated for the widespread adoption of RAAST-enabled QR codes as a cost-effective alternative to POS terminals.

“There is no reason every shop can’t have a QR code. We must reduce GST and broaden the tax base. Let’s stop waiting for global serenity and start changing what we can,” Ibrahim concluded.