Government offers incentives, aims for efficiency as it invites bids for national airline’s stake.

Key Takeaways:

i) Pakistan government invites global investors for the privatization of Pakistan International Airlines (PIA), offering a stake between 51% and 100% along with management control.

ii) This move is part of a larger economic reform agenda to reduce the burden of state-owned enterprises and attract investment in the aviation sector.

iii) The government is offering incentives like potential GST exemption on new aircraft and support for PIA’s balance sheet to attract serious bidders.

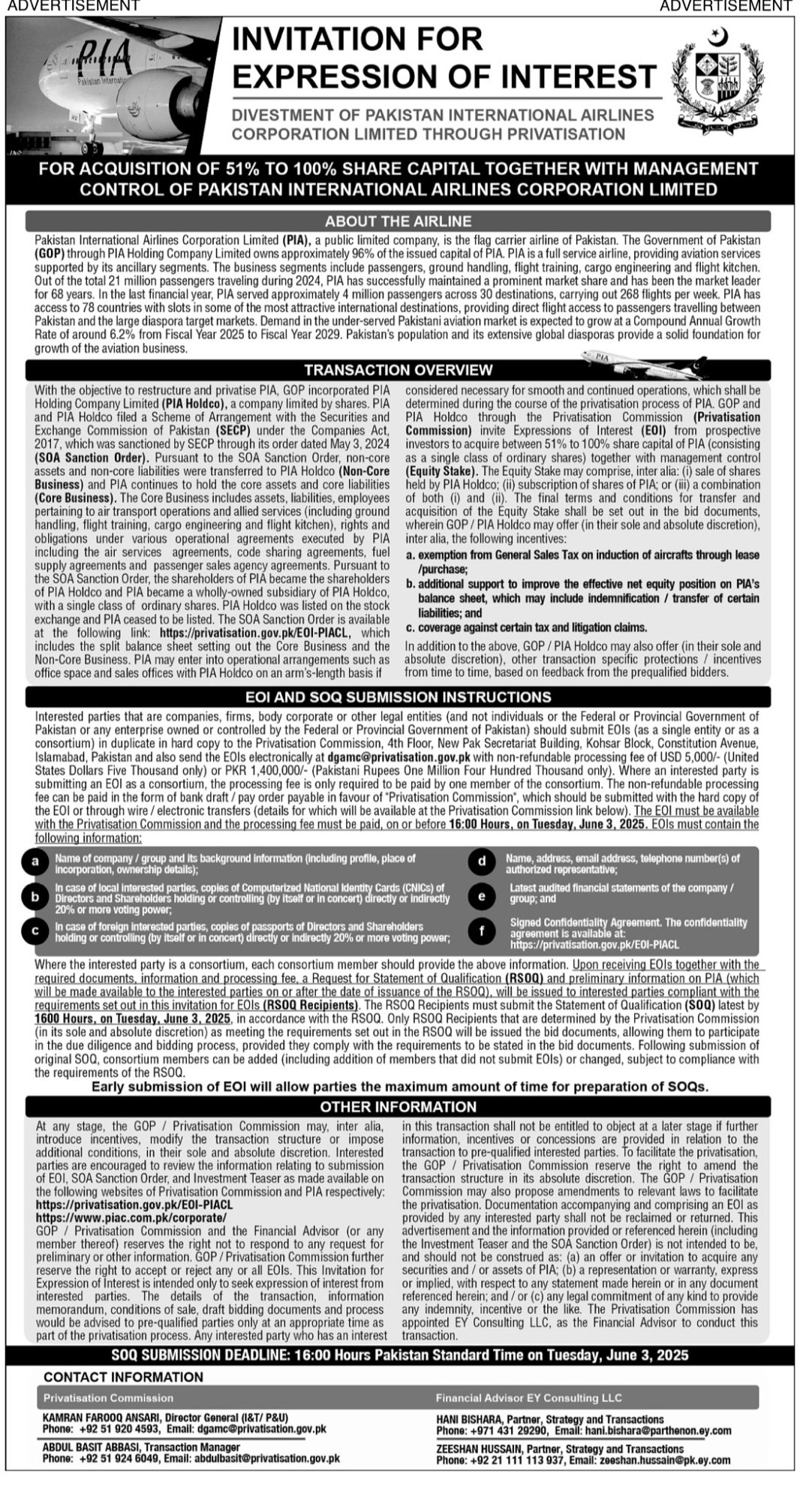

Money Matters Monitoring – In a bold step to overhaul its struggling national airline, Pakistan has formally announced an invitation for global investors to express interest in acquiring a significant portion of Pakistan International Airlines (PIA). The government is offering a stake ranging from 51% to 100%, which would also grant the buyer management control of the airline. The call for investment was advertised in prominent international publications, including the New York Times, signaling the government’s strong commitment to this privatization effort.

This initiative is a cornerstone of the government’s broader plan to reform the economy by lessening the financial strain caused by state-owned enterprises (SOEs) and drawing in both foreign and local investment, particularly within the country’s aviation industry. Interested parties have until June 3, 2025, at 4:00 PM Pakistan Standard Time to submit their initial expressions of interest.

The scope of the proposed sale is comprehensive, encompassing all of PIA’s main business activities. This includes passenger services, ground handling operations, cargo transport, pilot and crew training facilities, the airline’s catering services, and its engineering division. By offering a complete package, the government aims to attract investors looking for a fully operational aviation business.

To ensure that only serious and capable investors participate in the bidding process, the Privatization Commission has established strict pre-qualification requirements. Potential buyers, whether they are individual companies or groups of investors, must submit their expressions of interest along with a non-refundable processing fee of USD 5,000 or PKR 1,400,000.

Acknowledging the past difficulties faced by PIA and in previous attempts at privatization, the government is offering several attractive incentives to potential bidders. These include a possible exemption from the 18% General Sales Tax (GST) on the purchase or lease of new aircraft, which could significantly reduce operational costs for the new owners. Furthermore, the government has indicated its willingness to provide additional financial support to strengthen PIA’s financial position. This could involve measures such as indemnification against certain liabilities, the transfer of specific debts, and coverage for particular tax and legal issues – steps designed to address concerns that deterred investors in the past due to PIA’s substantial debt.

A recent positive development that could make PIA a more appealing investment is the airline’s reported first annual profit in over two decades for the fiscal year 2024. This turnaround is seen as a significant indicator of potential for future profitability under new management. The government also forecasts a promising future for Pakistan’s aviation market, which is currently underserved and is projected to grow at an annual rate of around 6.2% over the next four years.

Despite these encouraging signs, the privatization of PIA remains a complex undertaking. The airline has a history marked by financial instability, operational inefficiencies, and a large burden of past debt. Previous attempts to privatize the airline have stumbled due to a lack of strong investor interest and disagreements over the airline’s valuation and the handling of its liabilities.

The government has stated that it has learned from past experiences and is treating the privatization of PIA as a top priority, with the goal of completing the process within the current year, 2025. A successful privatization is expected to not only bring in much-needed capital for the airline but also potentially lead to improved efficiency, better service quality for passengers, and a greater overall contribution to Pakistan’s economy.